Tax Refunds: Are Employees Claiming Their Dues?

When tax refunds are being discussed, usually what comes to mind is monies owed by the Kenya Revenue Authority (KRA) to corporates. However, even individual taxpayers are entitled to refunds from KRA when they overpay their taxes. Every end of the month (or other period as determined by the employment contract) an employee receives salaries or wages as payment for services rendered. Ironically, the government receives its share even before the employee has an opportunity to enjoy the fruit of their labour.

This is effected through the pay-as-you-earn (PAYE) system. Under PAYE, the employer deducts the tax payable by the employee from the gross salary. The tax payable should be net of any reliefs and deductions. The employer then pays the employee their net salary, after deducting the tax remitted to the KRA.

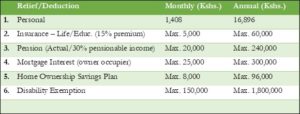

The tax reliefs and deductions applicable to individuals are as follows:

Where an employee is entitled to these tax reliefs but fails to get them, they end up overpaying tax. Tax over-payments may also occur where the monthly tax rates result in higher taxes as compared with the annual tax rates e.g. If an employee works for only part of the year. Any tax over-payments should be calculated and declared by the employee in their annual return. Where the employee fails to claim the tax over-payment, an amended return can be filed at any time.

The filing of the annual return showing a tax over-payment does not result in an automatic tax refund. The employee/taxpayer should take the next step of making a tax refund application. This is done on iTax ( KRA’s online platform) and an acknowledgment receipt is generated. This acknowledgment receipt should then be forwarded to KRA together with documents supporting the refund e.g. P9 form, insurance premium certificate, mortgage certificate, etc. Upon successful application, the tax refund is paid to the taxpayer’s bank account within ninety (90) days.

A note to business owners/self-employed persons

The reliefs and deductions discussed above are also applicable to individuals who are self employed e.g. in partnerships, sole proprietorships, etc. If the business owner earns a monthly salary, the deductions should be made each month and the above section on ‘employees’ would

be applicable. If however the business owner receives their share of business profit at the end of the year, the reliefs/deductions should be subtracted from this income using the annual rates.

Wrap Up

Though individuals should be diligent in paying their taxes, they are not expected to overdo it. Fortunately, the procedure for getting a tax refund is pretty straightforward and the timelines for receiving the cash are reasonable. The tax refunds are an efficient source of cash flow and taxpayers should not shy away from claiming their entitlements.

If you require support in amending your returns or applying for a tax refund, we are ready to assist. You can reach us on concepts@parexcellence.co.ke Store your grain not in your neighbors granary, but in your own!

© Par Excellence Concepts LLP